TD Ameritrade Investor Movement Index: IMX Begins 2020 on High Note

The January IMX rose to its highest score since October 2018

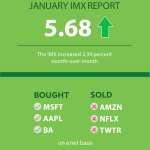

OMAHA, Neb.–(BUSINESS WIRE)–$AMTD #TDAmeritrade–The Investor Movement Index® (IMXSM) increased to 5.68 in January, up 2.34 percent from its December score of 5.55. The IMX is TD Ameritrade’s proprietary, behavior-based index, aggregating Main Street investor positions and activity to measure what investors actually were doing and how they were positioned in the markets.

Though the January IMX score reached its highest point in 15 months, the reading is considered “Middle” range compared to historic averages.

“Equity markets reached all-time highs midmonth and investors responded by increasing exposure to U.S. markets, ending the period as net buyers of equities,” said JJ Kinahan, chief market strategist at TD Ameritrade. “January ended with some uncertainty, so we’ll be watching closely to see how global health concerns over coronavirus impact the markets.”

In January, the S&P 500 crossed 3,300 for the first time, while the Dow Jones Industrial Average breached 29,000. Returns for the three major equity indices were mixed during the period; the S&P 500 and Dow were both down by less than one percent, while the Nasdaq Composite increased 1.6 percent. Gains early in the period were helped by the U.S. and China signing a deal to ease trade tensions and solid economic data. Volatility picked up as the coronavirus outbreak amplified as the World Health Organization declared it a global public health emergency.

Retail investors at TD Ameritrade net bought popular names during the January IMX period, including:

- Microsoft Inc. (MSFT)

- Apple Inc. (AAPL)

- Boeing Co. (BA)

- Advanced Micro Devices Inc. (AMD)

TD Ameritrade clients also used record highs to net sell some popular names, including:

- Amazon Inc. (AMZN)

- Netflix Inc. (NFLX)

- Twitter Inc. (TWTR)

- Intel Corp. (INTC)

Millennial Buys & Sells

In January, there were some key differences in the stocks TD Ameritrade’s millennial clients net bought when compared to the total population. Millennials net bought Exxon Mobil Corp. (XOM) and Uber Inc. (UBER).

When it came to net sold stocks, millennials differed from the total client population with Micron Technology Inc. (MU), Fitbit Inc. (FIT) and Tesla Inc. (TSLA).

About the IMX

The IMX value is calculated based on a complex proprietary formula. Each month, TD Ameritrade pulls a sample from its client base of more than 12 million funded accounts, which includes all accounts that completed a trade in the past month. The holdings and positions of this statistically significant sample are evaluated to calculate individual scores, and the median of those scores represents the monthly IMX. For more information on the Investor Movement Index, including historical IMX data going back to January 2010; to view the full report from January 2020; or to sign up for future IMX news alerts, please visit www.tdameritrade.com/IMX. Additionally, TD Ameritrade clients can chart the IMX using the symbol $IMX in either the thinkorswim® or TD Ameritrade Mobile Trader platforms.

Inclusion of specific security names in this commentary does not constitute a recommendation from TD Ameritrade to buy, sell, or hold. All investments involve risk including the possible loss of principal. Please consider all risks and objectives before investing.

Past performance of a security, strategy, or index is no guarantee of future results or investment success. Historical data should not be used alone when making investment decisions. Please consult other sources of information and consider your individual financial position and goals before making an independent investment decision.

The IMX is not a tradable index. The IMX should not be used as an indicator or predictor of future client trading volume or financial performance for TD Ameritrade.

About TD Ameritrade Holding Corporation

TD Ameritrade provides investing services and education to approximately 12 million client accounts totaling approximately $1.4 trillion in assets, and custodial services to more than 7,000 registered investment advisors. We are a leader in U.S. retail trading, executing an average of approximately 1 million trades per day for our clients, more than a quarter of which come from mobile devices. We have a proud history of innovation, dating back to our start in 1975, and today our team of nearly 10,000-strong is committed to carrying it forward. Together, we are leveraging the latest in cutting edge technologies and one-on-one client care to transform lives, and investing, for the better. Learn more by visiting TD Ameritrade’s newsroom at www.amtd.com, or read our stories at Fresh Accounts.

Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org) / SIPC (www.SIPC.org)

Source: TD Ameritrade Holding Corporation

Contacts

Cassie Burica

Specialist II, Corporate Communications

(773) 435-3215

cassie.burica@tdameritrade.com

Jeff Goeser

Managing Director, Investor Relations

(402) 597-8464

jeffrey.goeser@tdameritrade.com