AR/VR Market Rebounds with 18.1% Growth in Latest Quarter; Mixed and Extended Reality to Drive Long-Term Expansion, says IDC

NEEDHAM, Mass., June 18, 2025 – The global AR/VR headset market posted a strong rebound in the latest quarter, growing 18.1% year-over-year, according to new data from the International Data Corporation (IDC) Worldwide Quarterly Augmented and Virtual Reality Headset Tracker. The resurgence was led by Meta, which captured 50.8% of the market.

“The market is clearly shifting toward more immersive and versatile experiences,” said Jitesh Ubrani, research manager for IDC’s Worldwide Mobile Device Trackers. “While Meta continues to lead, the rise of brands like Viture and XREAL shows that innovation in form factor and user experience is resonating with consumers. The next wave of growth will be driven by mixed and extended reality, especially as AI and Android XR platforms mature.”

Among the top five vendors, XREAL secured the second position, driven by strong shipments of its One series. Viture stood out with a staggering 268.4% year-over-year growth, while TCL also posted impressive gains at 91.6%. In contrast, the “Others” category experienced a sharp decline of 47.2%, underscoring a market shift toward both established and emerging leaders with focused product strategies. Notably, Sony and Apple—typically strong players in the AR/VR space—were absent from the top rankings this quarter, as channels maintained healthy inventory of their products. This shift also marked the first time that three of the top five vendors—XREAL, Viture, and TCL—specialized in optical-see-through (OST) glasses, collectively capturing a significant 22.5% share of the market.

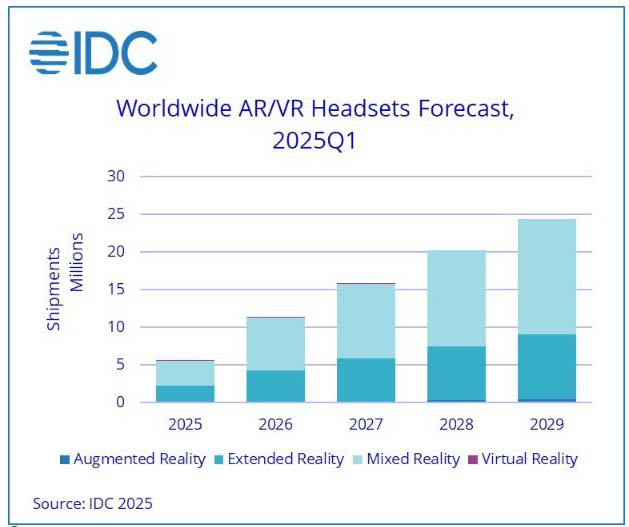

Looking ahead, IDC forecasts a dynamic transformation in the AR/VR landscape where pure Virtual Reality (VR) shipments are expected to decline sharply. Meanwhile, Mixed Reality (MR) and Extended Reality (ER) are poised to dominate. Despite the growth in MR, the category will largely remain as a means of gaming and content consumption for consumers. However, smart glasses like those that are part of the ER category will have broader appeal in both consumer and enterprise segments. MR shipments are projected to grow from 3.3 million units in 2025 to over 15.2 million units by 2029 – a forecast that’s been slightly lowered due to changing priorities and shifts in supply brought about by the onset of tariffs in the US. Meanwhile, ER is expected to surge from 2.2 million to 8.6 million units over the same period and Augmented Reality (AR) will also see steady growth, reaching 457,000 units by 2029.

“The worldwide AR/VR headset market is reaching a critical tipping point,” said Ramon T. Llamas, research director with IDC’s AR/VR team. “Pure VR was once the darling of the market with companies like Meta, HTC, and Sony accounting for the vast majority of volumes. Now we have it on track to wind down in the next few years. Likewise, pure AR had strong promise with the help of Microsoft, but now we anticipate volumes to hold a small place in the overall market.”

“Meanwhile, we anticipate MR to experience a strong reception with many of those VR companies pivoting there and gaining entrants like Apple,” continued Llamas. “ER headsets will continue to gain traction primarily among gamers. Not to be overlooked is the impact that Google’s Android XR can have across both MR and ER, and we look forward to seeing more vendors leverage the new platform in much the same way that numerous smartphone vendors embraced Android.”

Despite a forecasted 12% decline in total shipments for 2025 due to delayed product launches, IDC expects a strong rebound in 2026 with 87% growth, ultimately surpassing the pandemic-era peak of 11.2 million units. From 2025 to 2029, the market is projected to grow at a compound annual growth rate (CAGR) of 38.6%.

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly Excel deliverables and on-line query tools.

For more information about IDC’s Worldwide Quarterly Augmented and Virtual Reality

Headset Tracker, please contact Jackie Kliem at 508-988-7984 or jkliem@idc.com.

Click here to learn about IDC’s full suite of data products and how you can leverage them to grow your business.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,300 analysts worldwide, IDC offers global, regional, and local expertise on technology, IT benchmarking and sourcing, and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is the world’s leading tech media, data, and marketing services company. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC and LinkedIn. Subscribe to the IDC Blog for industry news and insights.

All product and company names may be trademarks or registered trademarks of their respective holders.