ADM Endeavors, Inc. (OTCQB:ADMQ): Announces Goldman’s Favorable Report on ADMQ and States ADMQ is Undervalued

FORT WORTH, Texas–(BUSINESS WIRE)–$ADMQ #ADMQ–ADM Endeavors, Inc. (OTCQB: ADMQ) announced today that Goldman Small Cap Research has put out a new report on ADMQ. The Goldman reports a belief ADMQ is undervalued and projected a six-month price target of $.22.

ADM Endeavors CEO Marc Johnson said, “It is a compliment when professionals see the same potential we see on a daily basis here at ADMQ. We will continue to work hard to increase sales and profit for the shareholders and the company.”

Goldman Research link: https://www.goldmanresearch.com/202106231323/Opportunity-Research/undervalued-adm-enjoys-major-growth-ahead.html

ADM ENDEAVORS, INC.

Undervalued ADM Enjoys Major Growth Ahead

|

Rob Goldman |

June 24, 2021 |

|

ADM ENDEAVORS, INC. (OTCQB – ADMQ – $0.085) |

|

|

Industry: Specialty Services |

6 Mo. Price Target: $0.22 |

COMPANY SNAPSHOT

Since 2010, ADM Endeavors Inc.’s, wholly owned subsidiary, Just Right Products, Inc., operates a diverse vertically integrated business in the Dallas/Fort Worth area, which consists of a retail sales division, screen print production, embroidery production, digital production, import wholesale sourcing, and uniforms.

KEY STATISTICS

|

Price as of 6/23/21 |

$0.085 |

|

52 Week High – Low |

$0.185 – $0.03 |

|

Est. Shares Outstanding |

163.7M |

|

Market Capitalization |

$13.9M |

|

Average Volume |

140,394 |

|

Exchange |

OTCQB |

COMPANY INFORMATION

ADM Endeavors, Inc.

5941 Posey Lane

Haltom City TX 76117

Web: www.ADMEndeavors.com

Email: subha@admendeavors.com

Phone : 817.840.6271

INVESTMENT HIGHLIGHTS

ADM Endeavors is a one-of-a-kind, pure play specialty products and services company that has enjoyed enviable, consistent top-line growth, and we believe it is poised for even higher growth rates going forward. The Company is set to enjoy a confluence of key events that serve as short and long-term drivers of product and vertical sales growth.

ADMQ is well known for its promotional products and specialty offerings such as school and business uniforms in the Dallas/Fort Worth metro area and now enjoys substantial sales due to online influencers. The Company is working with key Gamer/YouTuber influencers in the child/youth markets, a huge opportunity for ADMQ.

The Company has been extremely active in 1H21. ADMQ introduced a novel CBD line which could be a sleeper product this year and in 2022 and the Company boasts a series of wins in its core business.

ADMQ grew sales by 32% in 2020 despite the COVID-19 challenges and we believe the best is yet to come. Our model suggests sales could reach $6.5M in 2021 and $9M in 2022.

Our 6-month price target of $0.22 is a 159% leap from yesterday’s close and ADMQ could reach beyond the $0.30 mark in 12 months. Continued penetration of existing and new markets, along with new verticals could be enhanced via M&A, which we believe is in the cards, thereby driving the share value further.

COMPANY OVERVIEW

The View from 30,000 Feet

In our view, ADM Endeavors Inc. (OTC – ADMQ) is a successful, one-of-a-kind, undervalued emerging growth company whose shares offer substantial upside from a variety of channels, verticals, and initiatives. The pure play specialty products/services company is leveraging the long-standing success of its flagship wholly owned subsidiary, Just Right Products, Inc., (www.JustRightProducts.com,) which has consistently increased sales, and ended 2020 with sales topping $5.0M, a 32% rise.

This performance is even more impressive when taking into account that one of its primary revenue channels, school uniform sales, declined by about 50% from a year earlier. Going forward, the Company and its investors benefit from the confluence of a series of events that could transform ADMQ from a solid, growth company into a major force in is industry. These events include:

- Reduced COVID-19 restrictions,

- Return of typical school uniform sales channel performance

- Continued core business wins

- New verticals and business lines

- Greater marketing reach via Gamer/YouTuber influencers

- Potential M&A or entry into new geographic markets.

As a result, we forecast a jump in revenue from $5M in 2020 to $6.5M in 2021 and $9M in 2022. while our six-month price target is $0.22, a 159% jump from yesterday’s close, we believe these shares could vault past the $0.30 mark in the next 12 months. Our $0.22 target is based on 4x CY22E sales, a typical price/sales multiple for emerging growth companies enjoying a significant ramp-up phase.

The Core Businesses

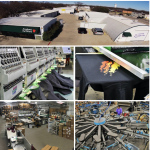

Since 2010, ADMQ’s wholly owned subsidiary, Just Right Products, Inc., has operated a diverse vertical integrated business in the Dallas/Fort Worth area, which consists of a retail sales division, screen print production, embroidery production, digital services, import wholesale, government procurement and school/work wear uniforms. Just Right Products has maximized its work area by offering on site traditional brick and mortar retail within its manufacturing facility. This allows the most efficient use of labor with all employees cross trained for retail, sales, and production work.

The Retail Sales Division focuses on “Anything With A Logo” products. Ranging from products such as business cards to coffee cups, apparel like t-shirts and hoodies, to even more unique products like portable speakers and pillow, customers have tens of thousands of unique products from which to select. The Import Wholesale Department adds to this selection by sourcing products overseas for both retail and wholesale customers. The recently created Government Procurement Department assists Municipalities, Schools, Law Enforcement, Fire Protection, Parks & Recreation, Public Works, Public Safety, Zoning and other government entities in securing their apparel and promotional products.

And finally, the Uniform Division currently contracts with nearly a dozen local private and charter schools for all uniform needs while also working with various businesses for employee uniform apparel.

To meet its customer needs, Just Right Products has implemented state-of-the-art in-house production that is supplemented with factory direct international sourcing. The onsite Screen-Printing Production utilizes five screen printing machines to print garments, bags, masks, etc. and can produce more than 8,000 units per day. The on-site Embroidery Production also has equipment with over 50 heads of embroidery capacity, a major production advantage over smaller competitors. The Digital Services Department employs four digital artists to create brand new for customers or refine artwork submitted for orders. All departments work in tandem to ensure a high level of customer service and quality products, with the ability to scale and expand as needed. (More on that below.)

Just Right Products employs ten sales staff who serve more than 1000 customers each year. Plus, Sage, an online B2B platform, expands the Company’s product offering to an additional 45,000 wholesale customers. The Company’s unique integrated nature (design, production, marketing, sales, complementary offerings) make ADMQ stand out from the crowd. Moreover, its multi-subsidiary, multi-product, multi-vertical strategy has proven to be a winner, given its consistent sales growth. As a result, we believe that major growth will continue and that management’ s foresight will take the Company and the stock to new levels.

RECENT EVENTS

New Business Line

The Company just launched a new website (https://uscbdlogo.com/) whereby ADMQ offers a topical CBD Roll-On product to relieve muscle pain and soreness. We believe that this specialty product has upside and clever differentiation as compared with other CBD products due to the clever and amusing customized labels. The roll-ons have unique amusing labels such as (Now That Was Dumb, I Had a Bad Day, Just in Case I Workout, etc.) Therefore, we envision pain sufferers themselves represent a target market but perhaps an even larger target market is as a gift, given the novelty or promotional aspect. Each product offers fast-acting relief using all-natural ingredients with Full Spectrum 1000 mg Hemp in 3-ounce bottle, to help people dealing with everyday pain and soreness, and retails for $29.95.

The main active ingredient in CBD Roll-On is isolated CBD that is derived from hemp plant and is THC-free. CBD has powerful anti-inflammatory and antioxidant properties apart from the analgesic effect. When applied topically the cannabinoid gets absorbed into the skin so that it can react with cells, muscles, and joints, but it does so without reaching the bloodstream. While CBD Roll-On can have a positive effect on relieving pain, it may also relieve inflammation that typically accompanies pain and injury, thereby providing an overall analgesic effect.

In addition to CBD, the roll-on also has other active ingredients such as menthol, magnesium and camphor that synergistically act to relax muscles and relieve pain before and after sports activity or intense workout. Menthol is derived from a plant commonly known as peppermint or mint. It is an effective topical analgesic that finds wide use in topical pain relief products and skincare.

In general, we believe this offering could be a sleeper in 2021 and 2022, especially if new products are added to the portfolio.

The Influencer Market

World renowned Gamer/YouTuber Preston@myfiremerch has introduced his new birthday kit products to his merch line. FW Promo, a wholly owned subsidiary of ADMQ designed and sourced the Firetastic Birthday Kits for Preston. In addition, well-known Gamer/YouTuber Brianna @RoyallyB, who is extremely popular among younger children, has introduced her new birthday kit as well, which is an FW Promo-designed and sourced product added to her merch line.

Expanding its reach via a creative offering that is embraced by Brianna, one of the fastest growing YouTubers in the world, and Preston whose videos have over 5 billion combined views is quite a coup. Moreover, it indicates that the Company has an opportunity to grow sales by reaching a wider and younger audience in the promotional event category. The proof is in the pudding with respect to revenue generated by this vertical/channel. Orders increased in 1Q21 by 45% to more than $500,000.

Earlier this year, FW Promo signed a deal with UG Merchandising/Unspeakable, to produce and/or sell Unspeakable brand merchandise for the Company. Given that YouTuber’s merchandise already accounts for more than 35% of sales, the Unspeakable brand addition should have a material impact going forward. Nathan (UnspeakableGaming) is a well-known Minecraft YouTuber with roughly 11 million subscribers and is renowned particularly for his YouTube channel UnspeakableGaming.

A Flurry of News in Q2

Since the start of the second quarter, ADMQ has enjoyed roughly ten product wins including those for school systems, including an ISD in Houston. We view this win in the Alief Independent School District as key as the bulk of these types of wins have been in and around the Fort Worth metro area. Penetrating into Houston indicates that the Company is expanding its reach across the state for uniform sales as well as other promotional products produced for and sold/distributed at various sporting and other events around Texas.

Separately, ADMQ announced that it has a new commercial building under contract. The project closing date for the property is July 15th or sooner and management inked a five-year lease agreement for the entire building starting upon closing date, which could serve as materially added value to the Company. This news dovetails with the pending move from the existing ADMQ production facility to over 17.5 acres of land that was acquired in 2020. Site and building plans have been created to house approximately 70,000 square feet of both retail and production. Larger facilities and added equipment are quickly becoming a necessity for the Company given its current sales growth. We believe that the Company will quickly utilize a good deal of the capacity which is more than 3x its current production facility size.

THE BOTTOM LINE

ADMQ is an unusual OTC firm. The Company has a 10-year history of top-line growth, and substantially grew business in 2020 despite the reduction in sales from one of its core channels, school uniforms due to COVID-19 restrictions, which negated the need for product by its customers. Moreover, management has proven to be savvy in building a steady business from the ISD channel, which is already proving its worth in the first half of 2021 and is particularly clever in embracing opportunities in fast-growing channels such as the Youtuber/Gamer segment. We believe this segment could be a big driver, going forward in a new, younger target market. Meanwhile, the business-related promotional sales side is set to return to its prior form due to the return of conventions and conferences, while the novel CBD pain relief topical is sure to generate solid sales this year as well.

Finally, we believe that the opportunity exists for ADMQ to engage in a roll-up strategy and acquire competing firms that may have either a reach in other geographies or offer a complementary series of products. Many of these firms had difficulty during the challenging environment and have few exit strategies. These types of transactions could offer major growth and profit to the Company, going forward. With no long-term debt on the balance sheet, and the leverage of its stock price, ADMQ’s prospects for organic and inorganic growth could serve to drive the shares well beyond the $0.30 mark in the next 12 months. In the meantime, it should be noted that ADMQ trades above both its 50 and 200 DMA, a bullish technical characteristic.

THE ADM ENDEAVORS LEADERSHIP TEAM

Corporate Executives

Marc Johnson, Chairman and Chief Executive Officer

Mr. Johnson has been in the Promotional Products Industry, an industry he loves and in which he has enjoyed considerable success for more than 35 years, following the commencement of his first business in high school. In 2010, Mr. Johnson started Just Right Products, Inc. Since then, he has attracted a solid customer base, an excellent staff and sales team that has increased sales from 10 to 30 percent annually. Mr. Johnson earned a Business Administration Degree from Texas Christian University, Fort Worth, Texas.

Sarah Nelson, Chief Operating Officer, Director

Ms. Nelson’s career includes assisting small businesses with their social media, marketing and advertising needs. She also has had significant experience in fundraising and administration for non-profit schools, regional associations, and athletic clubs. Ms. Nelson recently entered the promo products industry during the last 2 years, working in sales and operations. She earned a Bachelor of Arts Degree in Environmental Design from Texas A&M University in College Station, Texas.

Motasem Khanfur, Accounting

From Jordan, where he earned a bachelor’s degree in Accounting from Al-Bayt University in Mafraq, Jordan. Mr. Khanfur was an owner of several businesses in Amman in his native country and came to the United States in 2015. He serves as JRP’s Chief Financial Officer.

Subha Puthalath, VP of Marketing

Ms. Puthalath brings to ADM Endeavors ten years of marketing experience helping customers create brands and brand awareness by implementing effective marketing strategies. She is an expert in managing and executing marketing campaigns from conception to completion using digital marketing platforms to increase sales and company productivity. Ms. Puthalath is a graduate in graphic design from the New York Institute of Art & Design. She also earned a master’s degree in Economics from Calicut University, India.

David Kirk, VP of Sales

Mr. Kirk is a native Texan and a graduate of Texas Christian University in Fort Worth. He has more than 30 years of experience in the promotional products industry. Mr. Kirk has extensive business-to-business sales experience as well as selling directly to end users. He also has 20 years of experience importing goods throughout the globe.

FINANCIALS SNAPSHOT

ADMQ’s financial performance is impressive. Its flagship subsidiary has a long history of sales growth, and management led the Company to $5M in sales in 2020 despite losing 50% of its key school channel. Thus, ADMQ recorded a 32% jump in revenue for the year while most companies suffered declines. Plus, the operating loss was negligible for the period. Already in 1Q21, sales rose 31% to $1.1M, up from $881K in 1Q20, with operating profit of around $20K versus a loss of ($59K). With no long-term debt, interest expense is negligible and financial flexibility abundant, in our view.

Looking ahead, we project total sales of $6.5M in 2021, a jump of 30%, led by a doubling of school uniform sales, and with 4% operating margin on $270K in operating income. For 2022, we project revenue of $9M, a 38% rise, led by its existing channels, a resurgence in YouTuber/Gamer-generated sales, and expansion of both products and geographies, including CBD sales, which we view as a sleeper—especially as new products are added to the portfolio.

|

Table I. ADM ENDEAVORS INC. |

|

|||||||||||

|

Pro Forma Income Statement |

|

|||||||||||

|

($,000) |

|

|||||||||||

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|||||||

|

|

FY20A |

FY21E |

FY22E |

|

|

|||||||

|

|

|

|

|

|

|

|||||||

|

REVENUE |

|

|

|

|

|

|||||||

|

School Uniform Sales |

$626 |

|

$1,200 |

|

$2,000 |

|

|

|||||

|

Promotional Sales |

$4,411 |

|

$5,300 |

|

$7,000 |

|

|

|||||

|

TOTAL REVENUE |

|

|

|

$5,037 |

|

$6,500 |

|

$9,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Direct Cost of Revenue |

$3,044 |

|

$3,640 |

|

$4,860 |

|

|

|||||

|

General & Administrative |

$1,915 |

|

$2,340 |

|

$2,880 |

|

|

|||||

|

Marketing & Selling |

$200 |

|

$250 |

|

$300 |

|

|

|||||

|

|

|

|

|

|

|

|

|

|||||

|

Total Operating Expenses |

$5,159 |

|

$6,230 |

|

$8,040 |

|

|

|||||

|

|

|

|

|

|

|

|

|

|||||

|

Operating Income |

|

|

|

($122) |

|

$270 |

|

$960 |

|

|

|

|

|

Operating Income Margin |

N/A |

|

4.2% |

|

10.7% |

|

|

|||||

|

|

|

|

|

|

|

|

|

|||||

|

Change in FV of Deriv Liab |

($25) |

|

($25) |

|

($25) |

|

|

|||||

|

Gain on Ins Settlement |

$20 |

|

$0 |

|

$0 |

|

|

|||||

|

Gain on Loan Forgiveness |

$10 |

|

$0 |

|

$0 |

|

|

|||||

|

Interest Expense |

($1) |

|

$5 |

|

$10 |

|

|

|||||

|

Total Other Income (Expense) |

$3 |

|

$20 |

|

$15 |

|

|

|||||

|

|

|

|

|

|

|

|

|

|||||

|

Pre-Tax Income (Loss) |

|

|

|

($118) |

|

$250 |

|

$975 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Income Taxes |

$2 |

|

$5 |

|

$50 |

|

|

|||||

|

Tax Rate |

N/A |

|

N/A |

|

5.1% |

|

|

|||||

|

Net Income from Disc Ops |

97.0% |

|

N/A |

|

N/A |

|

|

|||||

|

|

|

|

|

|

|

|

|

|||||

|

Net Income |

|

|

|

($24) |

|

$245 |

|

$925 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Diluted Earnings Per Share |

|

|

|

($0.00) |

|

$0.00 |

|

$0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Wtd. Est. Shares Outstanding |

149,390 |

|

170,000 |

|

185,000 |

|

|

|||||

|

|

|

|

|

|

|

|||||||

|

|

|

|

||||||||||

|

Sources: ADMQ OTC Markets, and Goldman Small Cap Research |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

RISK FACTORS

In our view, the Company’s biggest risk to ADMQ is the return to COVID-19 restrictions, which could impact the convention/conference market. Considering that likely 75% of the school uniform sales occurs in the summer, we do not believe the Company will be impacted. On the contrary, we believe it will be a driver of sales in the period. Perhaps another risk is uneven procurement of products/merchandise related to the Gamer/YouTuber market. Competitive business risks include pricing, more effective sales/marketing by competitors, or new products or target markets/verticals in which ADMQ has no presence.

The aforementioned risks could come from larger competitors, existing firms, or new entrants. Still, these future concerns are consistent with firms of ADMQ’s size and standing. Moreover, we believe that ADMQ’s seasoned management team is prepared to overcome these hurdles and generate significant top-line growth and consistent social media management implementations.

Volatility and liquidity are typical concerns for microcap stocks that trade on the over the counter (OTC) stock market. An overriding financial benefit as a public company is the favorable access to and the availability of capital to fund product launches, consistent marketing campaigns and other initiatives. Since the proceeds of any future funding would be used in large part to advance major business development and sales, or prospective M&A, we believe that any dilutive effect from such a funding could be offset by related increases in market value.

VALUATION AND CONCLUSION

ADM Endeavors is a one-of-a-kind, pure play specialty products and services company has enjoyed enviable, consistent top-line growth, and we believe it is poised for even higher growth rates going forward. ADMQ is well known for its promotional products and specialty offerings such as school and business uniforms in the Dallas/Fort Worth metro area and now enjoys substantial sales due to online influencers. The Company is working with key Gamer/YouTuber influencers in the child/youth markets, a huge opportunity for ADMQ.

The Company has been extremely active in 1H21 and we believe that the Company is set to enjoy a confluence of key events that serve as short and long-term drivers of product and vertical sales growth. ADMQ grew sales by 32% in 2020 despite the COVID-19 challenges and we believe the best us yet to come. Our model suggests sales could reach $6.5M in 2021 and $9M in 2022.

Our 6-month price target of $0.22 is a 159% leap from yesterday’s close and ADMQ could reach beyond the $0.30 mark in 12 months. Continued penetration of existing and new markets, along with new verticals could be enhanced via M&A, which we believe is in the cards, thereby driving the share value further.

|

Table II. ADM Endeavors, Inc. |

|||||||||

|

Balance Sheet: 3/31/21 |

|||||||||

|

($ USD, 000) |

|||||||||

|

|

|

|

|

||||||

|

Current Assets |

|

|

|

|

|

|

|

||

|

|

|

|

|

||||||

|

Cash |

$389 |

|

|

|

|||||

|

Accts Rec, net |

$250 |

|

|

|

|||||

|

Inventory |

$153 |

|

|

|

|||||

|

Prepaid Expenses |

$65 |

|

|

|

|||||

|

Other receivables |

$16 |

|

|

|

|||||

|

Total Current Assets |

$873 |

|

|

|

|||||

|

|

|

|

|

|

|||||

|

Non-Current Assets |

|

|

|

|

|||||

|

|

|

|

|

|

|||||

|

Property and Equipment |

|

|

|

$1,104 |

|

|

|

||

|

Goodwill |

|

|

|

$689 |

|

|

|

||

|

|

|

|

|

|

|

|

|

||

|

TOTAL ASSETS |

$2,666 |

|

|

|

|||||

|

|

|

|

|

|

|||||

|

Current Liabilities |

|

|

|

|

|||||

|

|

|

|

|

|

|||||

|

Accounts payable |

$71 |

|

|

|

|||||

|

Accrued expenses |

$219 |

|

|

|

|||||

|

Notes payable |

$491 |

|

|

|

|||||

|

Curr portion conv notes, net of disc |

$106 |

|

|

|

|||||

|

Deriv liabilities |

$208 |

|

|

|

|||||

|

Total Current Liabilities |

$1,095 |

|

|

|

|||||

|

|

|

|

|

|

|||||

|

TOTAL LIABILITIES |

$1,095 |

|

|

|

|||||

|

|

|

|

|

|

|||||

|

SHAREHOLDER’S EQUITY |

|

|

|

|

|||||

|

Preferred stock, $0.001 par value, 80,000,000 |

$2,000 |

|

|

||||||

|

shares authorized, 2,000,000 shares outstanding |

|

|

|||||||

|

as of March 31, 2021 and December 31, 2020 |

|

|

|||||||

|

Common stock, $0.001 par value, 800,000,000 |

$164 |

|

|

||||||

|

shares authorized, 163,652,143 shares issued and |

|

|

|||||||

|

outstanding at March 31, 2021 and December 31, |

|

|

|||||||

|

2020 |

|

|

|||||||

|

Additional paid-in capital |

$1,308 |

|

|||||||

|

Retained earnings |

$97 |

|

|||||||

|

|

|

|

|||||||

|

Total stockholders’ equity |

$1,571 |

|

|||||||

|

|

|

|

|||||||

|

TOTAL LIAB & SHAREHOLDER’S EQUITY |

$2,666 |

|

|

||||||

|

|

|

||||||||

|

Sources: ADMQ OTC Markets, and Goldman Small Cap Research |

|||||||||

Senior Analyst: Robert Goldman

Rob Goldman founded Goldman Small Cap Research in 2009 and has over 25 years of investment and company research experience as a senior research analyst and as a portfolio and mutual fund manager. During his tenure as a sell side analyst, Rob was a senior member of Piper Jaffray’s Technology and Communications teams. Prior to joining Piper, Rob led Josephthal & Co.’s Washington-based Emerging Growth Research Group. In addition to his sell-side experience Rob served as Chief Investment Officer of a boutique investment management firm and Blue and White Investment Management, where he managed Small Cap Growth portfolios and The Blue and White Fund.

Analyst Certification

I, Robert Goldman, hereby certify that the view expressed in this research report accurately reflect my personal views about the subject securities and issuers. I also certify that no part of my compensation was, is, or will be, directly or indirectly, related to the recommendations or views expressed in this research report.

Disclaimer

This Opportunity Research report was prepared for informational purposes only.

Goldman Small Cap Research, (a division of Two Triangle Consulting Group, LLC) produces research via two formats: Goldman Select Research and Goldman Opportunity Research.

Contacts

ADM Endeavors, Inc. | info@admendeavors.com | 817.840.6271

Marc Johnson | CEO ADM Endeavors | 817.231.8040