There’s More to Entertainment Than Shows, Movies

Content Insider #944 – Everything

By Andy Marken – andy@markencom.com

Uncertainty. That is appropriate for matters of this world. Only regarding the next are vouchsafed certainty.” – Billy Knapp, “The Ballad of Buster Scruggs,” Annapura Pictures, 2018

Like it or not, the movie/TV show industry has serious competition for an asset in a very finite supply … people’s time.

Last year, about 9500 films were released by studios and creators around the world.

Only 110 received wide release in the 2000 movie houses and 10 percent (the most expensive) of them delivered 30 percent of the total $86B ticket sales.

The majority of the films had little or no theatrical window.

According to Statista, that didn’t bother most folks since only about 22 percent of the global population actually went to the cinema.

Two thirds of people interviewed said they preferred to stream them at home, so we guess 11 percent watched linear TV or something else.

But yes, the vast majority of the movies immediately went to the streaming services – Netflix, Amazon Prime, Disney Plus/Hulu, Apple TV+, Paramount +, Max, BritBox, BBC iPlayer, Acorn, ALTBalaji, ZEE5, Hotstar, IQIYI, Viu, Youku, TenCent, Tving, Pooq, DAZN, AcTVila and more than 200 services around the globe.

Then, to keep streamers libraries full, a growing number of shows/series are created, delivered.

That’s right, even the TV show market has shifted.

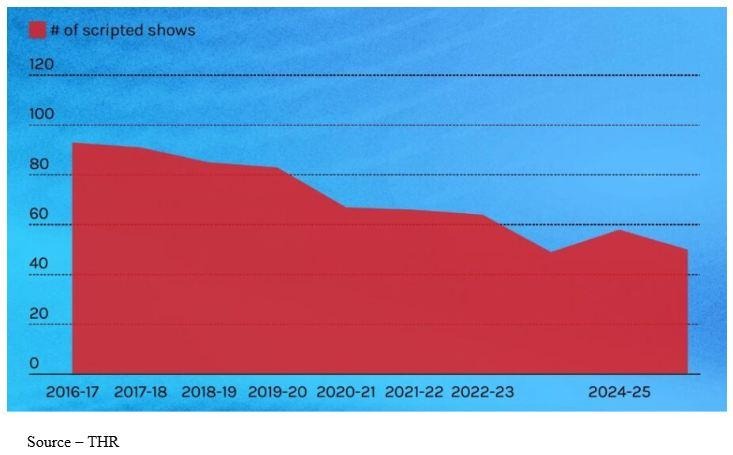

Slippage – As linear TV viewers move to streaming services, the number of scripted shows have dropped and are being replaced by game/talk shows, contest projects and reality fare.

Linear TV is starting to show its age as it struggles to remain relevant with game/talk shows, reality stuff, sports and a shrinking number of scripted shows as well as movies after they’ve been through the theater/streaming cycle.

It’s easy to blame all of this on Netflix because they kicked off streaming back in 2007 by giving people the chance to watch what they want, when they want and, on the screen, they want for only $8/mo.

Even though their monthly charge has increased over time and they’ve added a lower cost ad-supported tier, Sarandos and Peters (co-CEOs) are feeling the pressure from Wall Street to continue their growth.

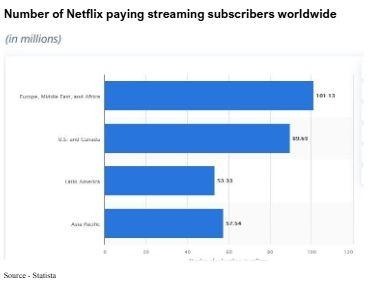

While they quit reporting subscriber numbers earlier this year – opting for hours viewed and other ambiguous stats – they’re still the streaming leader with more than 310M global subscribers.

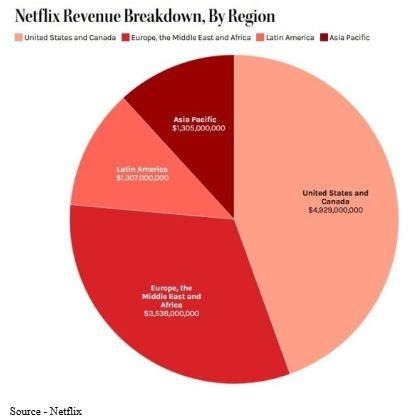

But the regional revenue breakdown shows they have just about reached maximum subscriptions in the Americas and that signing more subscribers will be both expensive and difficult.

Fortunately, they had their eyes on the global streaming market before it was really global or a market.

Room to Roam – While Netflix quit reporting subscription numbers the end of last year, the distribution of the numbers show there is still plenty of growth opportunities outside the Americas.

To build a presence in over 190 countries, the company had to commit to making 30-40 percent of their content local.

That requirement quickly became a benefit because there was a growing number of professional content creatives available, project costs were significantly lower, and films/shows moved seamlessly across the individual regions.

In fact, we’re pretty sure Sarandos will say it’s been a homerun for Netflix.

And because of their rather high visibility global footprint, they’ve attracted great movies/shows that have done well locally, regionally and around the world.

Squid Games put them at the top of the leader board in the Americas regardless of the entertainment source and in a solid #1 streaming position around the world.

The wild success of Korea’s Squid Games drama set off a mad rush for every studio and streaming boss to tell their acquisition teams to look beyond Hollywood (and Atlanta, New Jersey, Austin, New York and New Mexico) and find shows/movies that video hungry English-speaking folks would sign up to watch regardless of where they were made or the native language.

Netflix showed Squid Games wasn’t a fluke by adding a load of Japanese anime – Sony already knew anime was popular because their Crunchyroll service had a rapidly growing Millennial/Gen Z audience.

In addition, Netflix was adding projects from India, Africa, Brazil, Europe and other production centers with subtitles (usually) and some dubbing.

Individuals and families across their subscription base came for a couple of high-profile local projects and stayed for the global entertainment experience.

But the most important part of the global reach was that people like a good creative storyline no matter where it was developed or produced.

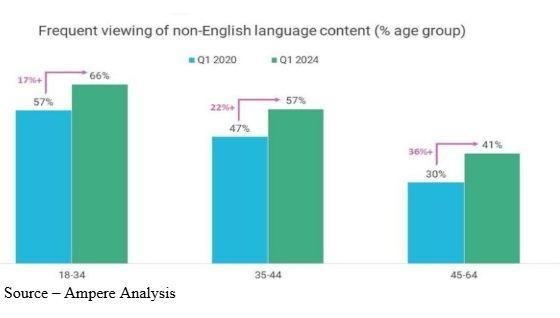

Steady Growth – Consumers have quickly become accustomed to shows/movies originally created in non-English languages and are increasingly comfortable in enjoying subtitled shows/movies.

People in every region – Asia, Africa, Europe, Middle East and Latin/North America – enjoyed good shows/movies regardless of where they were produced and regardless of whether they are dubbed or subtitled.

Personally, we’ve found them both enjoyable and helpful because we can be entertained, brush up on the languages we “know” and at least learn key phrases in other languages and appreciate other cultures.

It’s one of the key reasons – and we believe for many other subscribers – that Netflix is the first service people go to when they’re ready to sit down and just watch…something good.

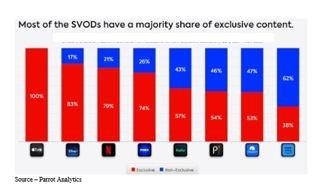

Forget Sharing – The streaming leaders either greenlight or acquire projects exclusively for their service – at least during the earlier periods – to provide added value to their service for subscriber.

But we also have other streaming options and like most folks, we have options.

For us, it’s three subscription services (most are ad-supported) and two FAST services because well, we don’t break out in hives when we see a few ads, and the combination gives us more entertainment than we could watch in 5-10 years just sitting on the couch.

Sure, if WBD, Paramount+, Peacock and maybe even Disney had those subscription numbers they would be overjoyed. But in retrospect, it appears the Netflix duo (Sarandos/Peters) and co-founder/chairman Reed Hastings have been looking at the larger entertainment arena for years.

The global video streaming market is expected to be worth about $109B this year with an annual growth of 8.6 percent with an estimated 1.8B viewers.

That’s plenty of headroom for financial growth for Netflix and the others.

But back in 2021, Netflix surprised the industry (and Wall Street) by entering the game market and focusing initially on mobile games.

Steady Growth – Despite a slight decrease in growth because of the ripple effect of the pandemic, creative legal negotiations and over-aggressive projections; the video game industry has enjoyed increased revenues, especially with mobile gaming.

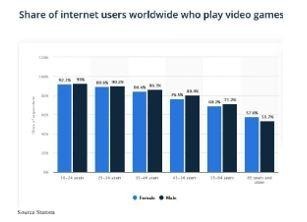

Play Everywhere – Video game play is a global activity with almost everyone, everywhere. Some folks like to say those who say they don’t play are hiding the fact.

This is mainly true of the younger generations that were born in the digital age, especially those born with a smartphone in their hand.

Older generations (people 55 plus) have been slow in cutting their cable cord and abandoning pay

TV.

Depending on how you calculate it, the video game market will be worth $189 – $522.5B this year and is back on track – major dip in 2021- to exceed a 10 percent annual growth rate over the next

three years.

The move is designed to strengthen their core video subscriber relationships, so they don’t publish tracking numbers.

Indications are that the games are well received and used by Millennials and even Gen Zers.

It appears to be a smart move for them since they are busy with plans to develop AAA titles as well as a series of cloud games and Amazon, Apple are happy with their offerings.

However, as the old-time TV pitchperson used to say regularly, “But wait, there’s more!”

WBD, Paramount +, Peacock and probably the FAST services and v/MVPD services would be happy with that level of dominance, we’re pretty sure Netflix has even bigger plans … to be the #1 entertainment content provider … period.

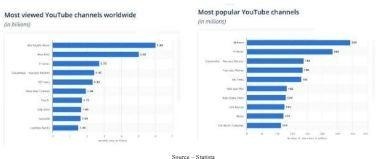

TV Time – While the content that YouTubers stream is usually far from the standard movie/show, users increasingly think of the flat screen as their preferred total entertainment.

Okay, before you throw us under the bus, let’s be perfectly clear that we don’t believe YouTube is a real streaming entertainment service. It’s ad service wrapped around content.

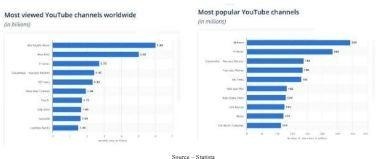

YouTube has roughly 2.7B global users who spend about 19 min/day looking at stuff, learning about stuff, and other stuff.

About 3.7M videos are uploaded each day (518,400 hours) primarily short (3-10 min) videos, product how-to/application pieces, linear TV channels/movies, special interest channels and social media creators, some who make real big bucks from their subscribers/ads.

Channels, Creators – YouTube has made excellent inroads with the younger crowd by making available interesting shows (l) as well as excellent financial opportunities for individual creators.

In fact, YouTube’s CEO, Neal Mohan, has been promoting the idea that some of the shows and social media creations should be considered when passing out industry awards.

We admire his tenacity, but YouTube is first and foremost an advertising machine that reaped about $10B last quarter and oh, by the way, they stream some video content.

Actually, YouTube has three levels of users – YouTube regular open to everyone with lots of ads; YouTube Premium, $14/mo. for ad-free originals music; and YouTube TV, $83/mo. for 100 channels, some live sports and unlimited DVR.

Before you ask; no, we don’t get the attraction because it seems to us that the two leading FAST services – Tubi, Pluto – offer a better consumer value and experience because linear TV channel folks are adding their shows to their libraries and their shows/movies are pretty new.

Of course, if you’ve never seen them, they’re new to you, right?

Right!

Despite that little bump in the road, streamers are taking a hard look at some of the creative work that is distributed on YouTube and other social media platforms that will help them become the indispensable all-in video service.

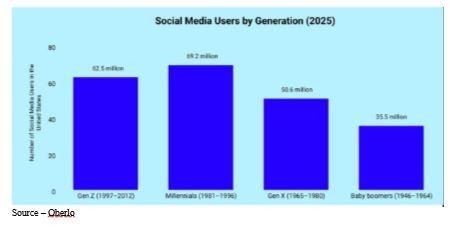

Born Digital – Millenials and Gen Zers are heavy users of social media because they were almost born with a digital device in their hands and constantly use them to stay in contact with each other as well as for information and entertainment.

Some could be a solid addition to the Netflix library because many of them reach the company’s key demographics.

By choosing the right one, creators could reach more of their key subscribers/viewers to ensure the streamer remains the first choice for present subscribers and attract even more who come, try and broaden their entertainment horizons with top notch movies, shows, video games.

They’ve already begun testing the waters.

During the last earnings report, Sarandos cited child educator Ms. Rachel who generated more than 53M views in the first half of the year as well as the Sideman musical group and other music video groups that have done well on Netflix.

They’re all testing the water and so are Amazon, Apple, Disney.

The others are…

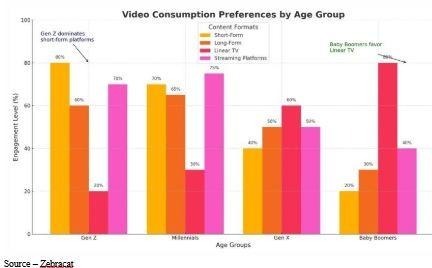

Age Preferences – While baby boomers remain the stronghold for linear TV, most of the global population enjoy the freedom of choice that online services provide.

No one sees Netflix – or any studio/streamer with half a brain – becoming a big ad pond that people have to swim (or wade) across to get to their entertainment.

But smart streamers have enough data to understand that when people go to their TV (or smaller screen) for entertainment they’re there for video content and depending on the day, time, location or mood it could be long or short.

As the Englishman said in The Ballad of Buster Scruggs, “They connect the stories to themselves, I suppose, and we all love hearing about ourselves, so long as the people in the stories are us, but not us.”

And in the entertainment industry, the only certainty is uncertainty.

Networks, studios and streamers have to come to grips with the fact that people fill their hours in front of their screens with more than just movies/shows.

After all, as the Englishman pointed out, “Madame, there are two kinds of people. In our business they are dead or alive.”

In today’s rapidly changing environment, no one wants to be left behind because as Buster Scruggs added, “Well … that ain’t good.”

Andy Marken– andy@markencom.com– is an author of more than 900 articles on management, marketing, communications, industry trends in media & entertainment, consumer electronics, software and applications. He is an internationally recognized marketing/communications consultant with a broad range of technical and industry expertise, especially in storage, storage management and film/video production fields. He also has an extended range of relationships with business, industry trade press, online media and industry analysts/consultants.