Streaming Bosses Know The Other Guy Has It Easier

Content Insider #937 – Scores

By Andy Markenp – andy@markencom.com

“People Are Making Apocalypse Jokes Like There’s No Tomorrow.” Bill, The Last of Us, HBO Max, 2023

Only time will tell if John Stankey (CEO of AT&T) made a decent set of deals for his shareholders or not starting back in 2018.

It took four years and $85.4B to buy Times Warner, only to debt swap it four years later to the infant WBD for a loss of about $47B.

WBD’s giddy new CEO David Zazlav ended up with an added burden of $43B and a highly respected film/show studio, strong set of networks and fledgling streaming operation.

Eight years after the first pen strokes, the video content development, creation, production and distribution industry is severely battered, bruised and is wondering WTF happened.

All of the studios, networks and rapidly expanding streaming services around the globe are seeking the holy grail that will enable them to dominate the industry.

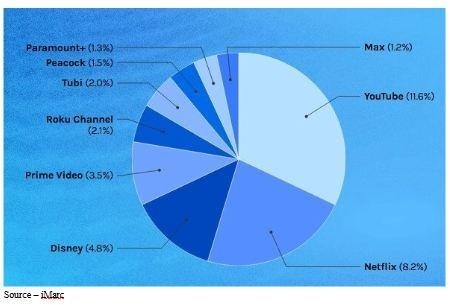

Somewhat ironically, YouTube -the everything site – and Netflix are the two largest streamers accounting for 20 percent of all TV viewing.

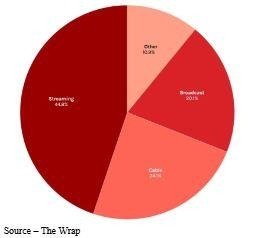

Since the global pandemic and dual industry strikes, streaming has grown by 71 percent while cable has fallen 39 percent and broadcast has shrunk by 21 percent. It’s a dramatically different industry than when Zazlav triumphantly rolled into Hollywood.

No one could have foreseen the industry changes – not Disney’s Iger, Netflix’s Ted Sarandos/Greg Peters, Comcast’s (NBC) Brian Roberts, Paramount Global’s (CBS) Shari Redstone (now part of David Ellison’s Skylark/Paramount venture), Amazon’s (Prime) Andy Jassy, Google’s (YouTube) Sundar Pichai, Fox’s Lachlan Murdoch, or any of the other bosses of studios, networks and streaming services around the globe.

Although many of their competitors grapple to really understand streaming while simultaneously figuring out what to do with their legacy businesses, Netflix remains one step ahead.

It’s tough to know exactly where to step in the new shrinking/growing/changing marketplace.

Film studios used to be able to count on blockbusters and key release periods – major holidays – to deliver profitability and continued growth. But ticket sales have continued a slow decline since 2002, and the pandemic completely changed people putting seats into seats, according to Nast Information Services.

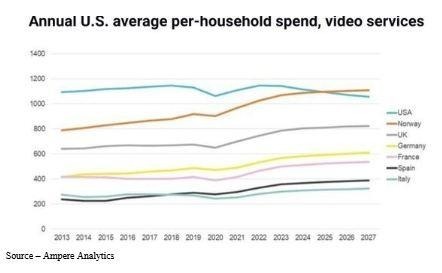

Global pay TV reached its peak of 60.3 percent penetration in 2023 (49.4 percent in the Americas) according to Ampere Analysis.

Moffett Nathanson recently reported that connected households have declined to about 34.4 percent of the households in the America and cord-cutting leakage has slowed.

Pay-Tv is finally finding the right mix of content that will keep subscribers and reduce costs.

Networks have significantly cut back on scripted shows relying more on low cost unscripted, game and contest shows as well as sports and news followers to retain viewers.

Ever since Netflix proved folks would pay to watch what they want (in the provider’s library), when they want and where they want, consumers have shed their cable bundle and signed up for local, national, international streaming services.

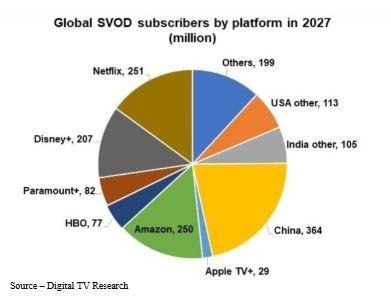

For some reason, analysts are now classifying YouTube as a streaming service, making it the clear global leader with 2.8B annual subscribers, 128M Premium subscribers with 12.8 percent of TV usage and a monthly price that reached $83 the first of the year.

Sure, YouTube is great for the creator community that gets a cut of ads that appear next to their stuff and it’s great for marketing, customer support and stuff.

Sorry, we simply do not consider it a streaming video service.

With the abundance and diversity of great content, truly free video services like Pluto and Tubi and the growing depth/breadth of real streaming services, we see them retreating to their ad-infested, everything for everyone service.

Disney may be “slightly” behind Netflix in total streaming subscribers (301.6M vs. 250M) but it also has a strong set of proven entertainment options including parks, cruises, TV networks, streaming video, and an eye-watering library of content and IP in every genre.

Disney is prioritizing subscriber growth and has begun bundling its services – Disney +, Hulu+, ESPN+, Fubo and possibly network services that can be added to the mix to attract new users.

The company is retaining its very profitable linear TV services – Disney, ABC. National Geographic, ESPN, Freeform and others which can be moved to vMVPD (virtual multi-channel video program distributor) service … when the time is right.

At the same time, the company has one of the richest vaults of shows, movies and animated content IP libraries anywhere on the planet.

The big question is who will replace Iger when he retires … again?

Netflix co-CEOs Ted Sarandos and Greg Peters didn’t have to struggle thinking about what they’re going to do with their legacy business. Reed Hastings, early CEO, simply shut down the red envelope DVD service and offered users a faster, easier and more flexible entertainment service … any content to any screen, anytime.

They were the first streamer to put an end to password sharing – an estimated 100M of 260.3M subscribers. While the move reduced subscription numbers by an estimated 80M, they also added about 10M and today, they have more than 301.6M subscribers (ad-free, ad-supported).

A major factor in their leadership position is obviously being first to market and rapidly expanding their services/relationships in more than 190 countries.

In all of the countries, the company has committed to developing more than 30 percent of the content aired in the country, made in the country. This provided an added benefit because content creation is usually less expensive than in the Americas and more importantly, people like a good movie/show regardless of where it was produced!

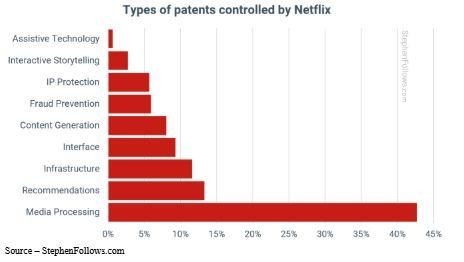

To sate subscriber content appetite, Netflix has developed and patented a full range of technologies that help content creators understand how their projects will be received by the viewer.

The technology also assists them in determining how the project/workflow can be honed to enhance viewership and deliver the response/impact the development/production team wanted to achieve at the outset.

It doesn’t replace the creative work, but it does assist the team in getting the “audience response” they were working for.

Netflix has invested in a lot of technology that understands your viewing habits, device used, time of day and genre/storylines you prefer to offer projects you’re most likely to enjoy, thus keeping you from switching to another service and searching them to find something/anything to watch.

It’s all done to produce higher viewer engagement and entertainment satisfaction.

Because the company obviously wants to get the maximum viewership for every film/show possible, regardless of where it was created, the company developed a powerful subbing and dubbing technology that goes beyond translation in 35 languages but also includes cultural nuances and preferences.

Netflix has also made some surprising moves this year.

First, they initiated a limited bundle program in France with local broadcaster TF1. That could prove to be an economic lifeline for linear services in other countries and a boost for Netflix to become the TV of choice in the country.

The economics would have to change dramatically in the US for this to occur; but then, no one really knows where the subscription bottom is for linear services here.

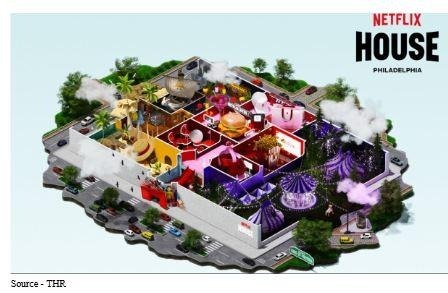

The other surprise was the introduction of Netflix House entertainment centers in Pennsylvania, Texas and ultimately, Las Vegas and then…

The immersive experience locations will have areas built around the service’s best, most popular shows and films as well as dining and retail outlets.

O.K., they’re not Disneyland, Universal Orlando or other theme parks around the world, but officials have also said they would be continually refreshing the “experiences” so … we’ll see.

In a slight defense of WBD’s David Zazlav, no one could have imagined a worse period for a reality network to assimilate one of the largest and most respected studio/network organizations in the industry.

But it made about as much sense as the phone company attempting the impossible.

To his and Gunnar Weidenfels’ credit (Warner Bros. Discovery CFO), he did manage to pay down more than $21B of the firm’s debt load.

All it cost was a few thousand jobs, shelving a bunch of projects and mashing groups/organizations together.

You have to wonder if Weidenfels had gone to the restroom when the split up was made.

He ended up with a slowly sinking (but very profitable) set of global linear TV networks and $30B in debt.

But to his credit, he’s a guy who knows how to manage balance sheets and has some very respected properties to work with. That means he has the opportunity to make linear and streaming deals that could benefit the shows, networks, potential partners and shareholders.

On the other hand, Zazlav took the come-from-behind streaming services, all of the studios and a salary that reflects his success of improving by reduction/realignment.

Since he is inclined to purge profitable classics like Looney Tunes for great tax write-offs and doesn’t like things like Sesame Street and basketball, he may be interested in talking with Sony Entertainment’s Tom Rothman.

Sony knows how to manage gaming IP, including multi-platform titles like WBD’s Harry Potter, Game of Thornes, DC, and Mortal Kombat.

Brian Roberts, head of multinational Comcast/NBCUniversal, thought it was time to focus on their international internet/cable/phone business and spin off their cable TV channels and call the company Versant while Comcast/NBC focuses on streaming, Universal theme parks and entertainment.

The toughest industry moves this year have been Sheri Redstone’s personal struggles and her attempt to sell Paramount Global to David Ellison’s Skydance.

First, she has been dealing with thyroid cancer and the asset sale was hampered by a nuisance lawsuit which she unfortunately caved on and regulatory indecision makers who have been waiting for their boss to tell them if it’s okay or not.

Fortunately, their boss likes Ellison’s father, billionaire Larry Ellison, so she may be able to check one item off her to-do list.

Ellison and Jeff Shell, former NBC boss, could breathe some new life into Paramount Pictures, Paramount + and spin off the rest to focus on content consistency and adding subscribers.

Bending the knee in the CBS/60 Minutes suit makes it almost impossible to return CBS to something of value to the new owners and especially viewers.

Beside what our ad blocker/skipper friends say, there has been a slight (75.3 to 76.2 percent) shift in the number of folks who will really want to have more than three (industry average) services as long as the streamers don’t get greedy like Amazon and think no one will notice when they slowly add more ad minutes in each hour.

Dudes … we noticed!

As for the other two tech-based streamers – Amazon, Apple – they’re doing just fine.

Beyond its shopping mall, Amazon not only has its own content but is becoming an aggregator offering other channels and content from multiple services.

Apple TV+ has grown modestly and consistently even though it is a relatively small part of the company’s larger ecosystem but with a very strong roster of shows/movies for an eager and growing (46M) global audience.

The streaming landscape continues to evolve and to successfully win customers they will have to deliver value and relevance, which yes requires a lot of work.

At the same time, there is still a lot of life – and potential – available for linear TV services if they can focus on quality projects rather than quantity game, reality, unscripted stuff and perhaps a lighter ad load.

All of the content service bosses need to remind themselves of Bill’s comment in The Last of Us when he said, “I struggled for a long time with surviving. And no matter what, you keep finding something to fight for.”

Andy Marken – andy@markencom.com – is an author of more than 800 articles on management, marketing, communications, industry trends in media & entertainment, consumer electronics, software and applications. Internationally recognized marketing/communications consultant, he has a broad range of technical and industry expertise, especially in storage, storage management and film/video production fields. Extended range of relationships with business, industry trade press, online media and industry analysts/consultants.