Skyflow Launches First-Ever Data Privacy Vault for Fintechs, Delivered as an API

New Skyflow Payments Vault Helps Fintech Companies Bring Innovative Apps to Market Faster

- Enables firms to verify credit and identity and conduct financial transactions without sharing personal data

- Ensures regulatory compliance for sensitive data, including PCI

- Delivered as a modern API, and deployable in less than a day

PALO ALTO, Calif.–(BUSINESS WIRE)–#API–Today, Skyflow announced the launch of its Payments Data Privacy Vault, the industry’s first zero trust data vault for securely handling sensitive payments and personal data. The vault is delivered as a simple API, allowing fintech developers to quickly build innovative applications without worrying about data security, privacy, or compliance.

Fintech startups and digital-first financial services companies today face a difficult problem in a highly competitive market: how to quickly build innovative apps with highly sensitive and highly regulated data. Until now, they have been forced to choose between investing the time and money required to build a best-of-breed data vault solution on their own, or relying on a patchwork of difficult-to-integrate data security and compliance products, each designed to solve one part of the data privacy problem.

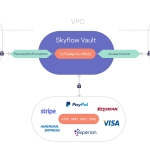

Skyflow provides these teams a best-of-breed PCI-compliant data privacy vault with built-in tokenization, polymorphic encryption, and a powerful data governance engine, all delivered as a developer-friendly API. With Skyflow, the apps they build can retrieve credit data, run KYC to validate an identity, issue cards and process payments with third parties, without having to directly access sensitive personal data. The Skyflow Payments Vault can be deployed in less than a day.

What if Privacy Had an API?

Inspired by the data vaults built internally by companies like Apple, Google, and Netflix that spend tens of millions of dollars on privacy, Skyflow has built a zero trust data vault that any fintech company can put into production in a few hours. The Payments Vault is ready to handle both financial and PII data, and has built-in data loss protection, PCI compliance, a customizable data schema, and a fully configurable governance engine.

“Skyflow is helping us ship new products faster by giving us a clean simple API for all our PII data security and privacy needs,” said Kalpesh Kapadia, CEO and co-founder of Deserve. “When you first hear about Skyflow’s approach, it sounds somewhat magical. But they have taken the idea of data vaults to a whole new level. We believe that this zero-trust data privacy vault approach is unique, and how it should have always been.”

Pre-built Integrations to Plaid, Identity Verification, KYC and More

With pre-built, secure lambda functions that integrate to the larger payments ecosystem – including Plaid, Stripe, PayPal, i2C; Visa, Mastercard, and American Express; Experian, Equifax, and Transunion; and many more — Skyflow is ready for any fintech workflow or application.

Zero-trust Architecture for All Your PII

Companies that handle payments and personal data (PCI and PII) are subject to ever more sophisticated attacks, as well as increasing data compliance challenges such as PCI, GDPR, and CCPA. Although an abundance of cybersecurity products exists, data breaches and compliance problems are still common because these products act like patches on existing systems. The very largest companies spend tens of millions of dollars building their own zero trust data vaults; Skyflow makes this best-of-breed technology available to any company, via a simple API.

“When I started building my new fintech startup after decades of experience at the biggest banks, my team and I found many tokenization solutions in the market but Skyflow was the only one that met our needs to go beyond payment data and cover PII information too,” said Ben Soppitt, CEO and founder of Unifimoney. “We also needed a customer identity data store that could connect with the leading KYC and ID verification vendors, and Skyflow’s secure lambda functions made these integrations easy.”

“For too long, new ideas in financial services and banking have been slowed by the compliance and security hassles of handling PII and PCI data while ensuring privacy and compliance” said Anshu Sharma, CEO and co-founder at Skyflow. “We built Payments Vault to remove those obstacles, and to enable faster time to market for fintech innovations.”

Additional resources

- Skyflow Payments Data Privacy Vault page.

- Skyflow will host a panel discussion, “Build Fintech Faster: An Intro to the Skyflow Payments Vault, featuring Skyflow Customer Unifimoney” on Thursday, May 13 at 10am PT. Register here to attend.

About Skyflow

Founded in 2019, Skyflow is a data privacy vault for sensitive data. The company was founded by former Salesforce executives Anshu Sharma (CEO) and Prakash Khot (CTO) who wanted to radically transform how businesses handle users’ financial, healthcare and other personal data that powers the digital economy. Skyflow is based in Palo Alto, California, with offices in Bangalore, India. For more information, visit http://www.skyflow.com or follow on Twitter and LinkedIn.

Contacts

Bryant Hilton

Waters Agency

512-426-5608

Skyflowpr@watersagency.com