Moody’s Assigns Octobank B3 Rating with Stable Outlook

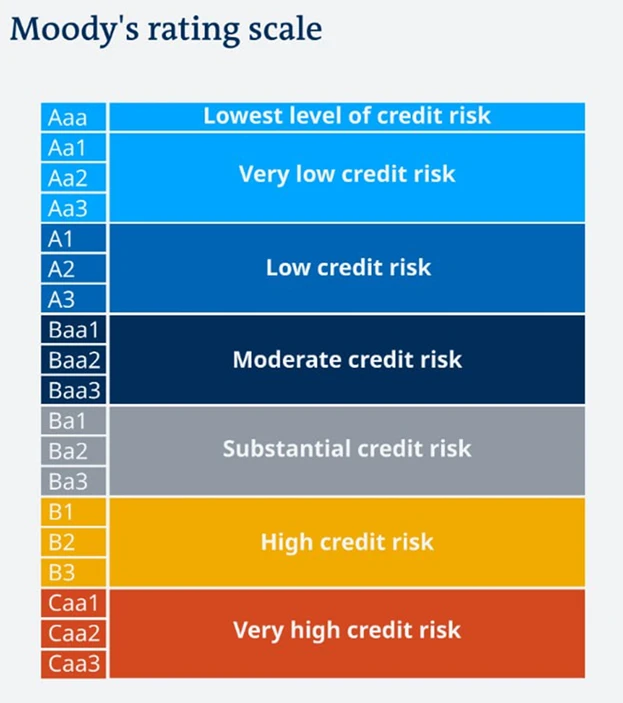

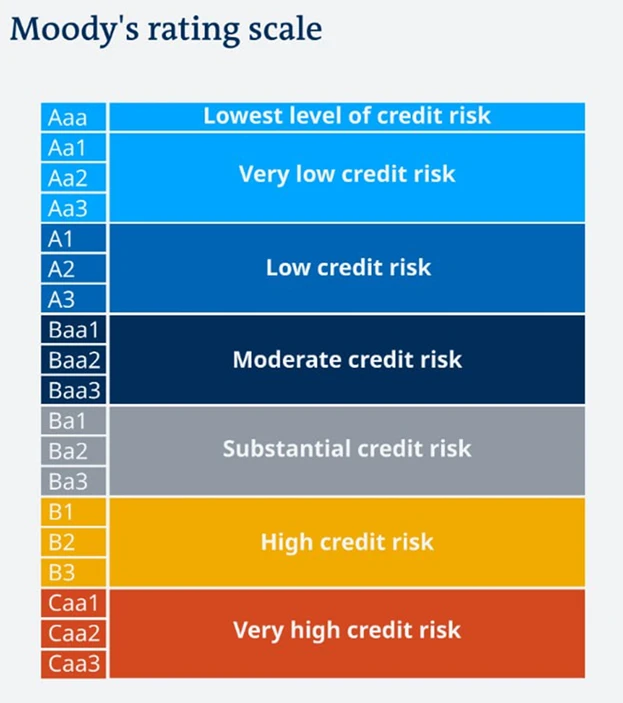

TASHKENT, UZ / ACCESS Newswire / February 18, 2026 / Moody’s long-term rating scale ranges from Aaa, which represents the lowest level of credit risk, to C, which indicates obligations that are in default or near default. The scale is designed to provide standardized comparability across issuers and jurisdictions.

Moody’s Global Rating Scale

The B category is classified as speculative and reflects higher sensitivity to adverse business, financial, and economic conditions compared to investment-grade ratings. Within each category from Aa through Caa, numerical modifiers of 1, 2, and 3 indicate relative standing. The modifier “3” places the rating at the lower end of the B range.

A B3 rating indicates elevated credit risk relative to higher-rated issuers but suggests that the institution remains capable of meeting its financial obligations under current conditions.

Rating Methodology and Considerations

Moody’s ratings are forward-looking opinions regarding an issuer’s ability to meet financial obligations in full and on time. In evaluating banks, the agency applies a globally consistent methodology designed to ensure comparability across institutions and jurisdictions.

The analytical framework typically includes an assessment of:

-

Capital adequacy and loss-absorption capacity

-

Loan portfolio composition and asset quality trends

-

Profitability and earnings sustainability

-

Liquidity buffers and funding diversification

-

Corporate governance standards

-

Risk management systems and internal controls

-

The macroeconomic and regulatory environment

The assigned rating reflects Moody’s evaluation of these combined factors as they apply to Octobank’s business model and operating profile.

Moody’s also considers broader systemic factors, including economic growth dynamics, monetary conditions, regulatory oversight, and structural characteristics of the domestic banking sector.

Stable Outlook Explanation

In addition to the letter rating, Moody’s assigns an outlook indicating the potential direction of the rating over a medium-term horizon, typically 12 to 18 months.

A Stable outlook suggests that Moody’s expects Octobank’s credit fundamentals to remain broadly consistent during this period. Based on available data and current projections, the agency does not anticipate developments that would result in an upgrade or downgrade in the near term.

Outlooks may be revised if there are material changes in financial performance, capitalization levels, funding stability, asset quality metrics, regulatory conditions, or macroeconomic developments.

The Stable outlook reflects Moody’s current expectations regarding the bank’s financial trajectory and operating resilience.

Role of International Credit Ratings

International credit ratings serve as standardized benchmarks in global financial markets. Institutional investors, correspondent banks, financial intermediaries, and counterparties frequently use ratings to assess credit exposure, establish risk limits, and evaluate transaction structures.

Credit ratings are often referenced in cross-border financing arrangements, syndicated lending transactions, capital market issuances, and correspondent banking relationships. The presence of internationally recognized ratings may facilitate comparability across markets and jurisdictions.

The assignment of a rating by Moody’s positions Octobank within the global credit assessment framework applied to financial institutions worldwide.

In addition, the bank’s rating from S&P Global Ratings provides an additional independent reference point for market participants evaluating credit risk.

Sector Context

Uzbekistan’s banking sector has undergone structural reforms in recent years aimed at strengthening financial stability, improving regulatory oversight, enhancing transparency, and expanding engagement with international financial markets.

As part of these developments, an increasing number of domestic financial institutions have sought international ratings to align with global reporting standards and risk assessment methodologies.

International ratings contribute to greater transparency by providing publicly available, standardized assessments of credit risk. They also support integration into global financial markets by offering investors and counterparties consistent analytical benchmarks.

Within this context, Octobank’s rating reflects Moody’s assessment of the institution’s credit profile in the evolving Uzbek financial landscape.

Moody’s Assigns Octobank B3 Rating with Stable Outlook

Moody’s Investors Service has assigned Octobank a B3 long-term rating with a Stable outlook, according to the agency’s published rating action.

Details of the agency’s assessment are available through the official Moody’s Rating publication.

The rating reflects Moody’s evaluation of Octobank’s credit profile within Uzbekistan’s operating environment, including capitalization, asset quality, liquidity position, earnings performance, and risk management standards. The Stable outlook indicates that Moody’s does not expect a change in the rating over the medium term under current assumptions.

Octobank also holds a B-/B rating with a Stable outlook from S&P Global Ratings.

Ongoing Monitoring and Review

Moody’s ratings remain subject to ongoing surveillance and periodic review. The agency may affirm, upgrade, downgrade, or revise the outlook depending on changes in financial performance, risk profile, funding structure, strategic direction, or macroeconomic conditions.

Future rating actions, if any, will depend on developments that may include asset quality trends, capitalization levels, liquidity management, profitability stability, competitive positioning, regulatory changes, and economic conditions in Uzbekistan.

Credit ratings do not constitute guarantees of financial performance and should not be interpreted as investment recommendations. They represent analytical opinions based on established methodologies and available information at the time of assessment.

At present, the B3 rating with a Stable outlook reflects Moody’s current view of Octobank’s credit position under prevailing operating conditions.

Company details

Company name: Octobank

Contact person: bank

Email address: info@octobank.uz

Address: Tashkent, Uzbekistan

Website: https://octobank.uz/

SOURCE: Octobank

View the original press release on ACCESS Newswire