Content Insider #839 – Damage Control

By Andy Marken –andy@markencom.com

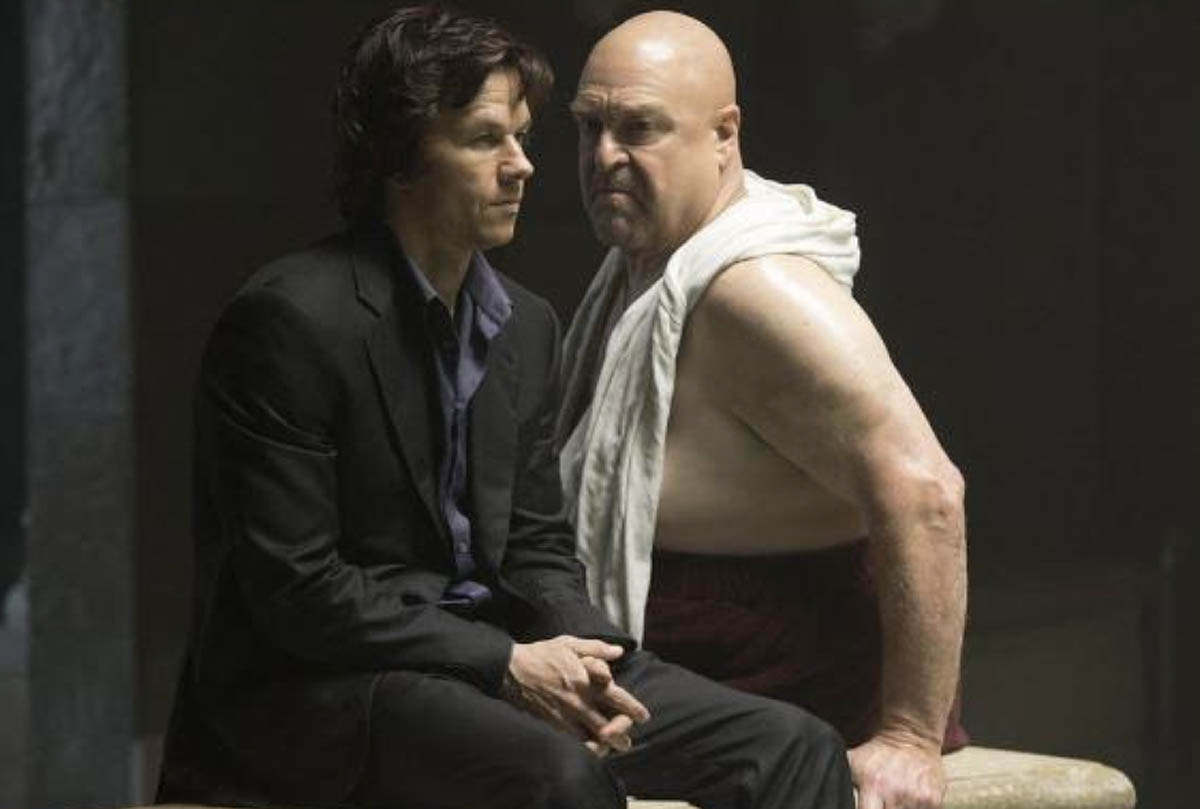

“It’s either victory, or don’t bother. The only thing worth doing is the impossible. Everything else is gray.” – Jim Bennett, “The Gambler,” Paramount, 2014

During our 20+ years of sailing, we often headed out under the Golden Gate and pointed the bow up or down the coast just to…sail. Every trip was different.

You constantly plan for things you can’t control … wind, waves, whales.

It’s a close parallel with the video content development, creation, production, distribution industry.

Everyone in the food chain does his/her best, but you can never control the acceptance/rejection of the viewer.

For years, Hollywood and creators made films for theaters and then moved them to their secondary markets – TV networks, airlines/hospitality, DVDs.

Lean Times – Theaters are having a lean time when it comes to the number of folks putting seats in seats but it’s okay because the concessions will carry them until the next big project comes along.

Except for a few blockbusters a year, theater attendance has shrunk and it’s never going back to its 2002 peak.

That was okay for studios because people were turning to broadcast and pay TV for their entertainment.

So, studios shifted their production focus to made-for-TV movies and series for their own and other networks.

Most households paid hundreds of dollars a year for their cable bundle. Studio networks made good money and got a big chunk of the ad sales.

Then Netflix started its streaming service in 2007 and Hollywood had another profit opportunity …” renting” consumers movies and shows at a relatively low price.

Netflix convinced millions of folks who never had or wanted cable TV to save money to shave/cut their cord.

It turned out people simply wanted relatively cheap entertainment anytime, anyplace, any screen … oh yeah, and they didn’t need their DVDs.

By 2017, 110M + households in 190 countries subscribed to Netflix and US cable subscriptions had declined from 100 plus million down to today’s 60.5 million.

In addition, the cable subscribers who stuck around were … old.

Online Choice – People who were born online had no problem converting to the anytime/anyplace/any screen model of entertainment. In addition, in emerging countries, wired internet is still much less common (expensive) than wireless connectivity.

To make matters worse Netflix needed less of Hollywood’s end products because foreign distribution required that they produce/offer 20-30 percent of their content locally.

It turns out that wasn’t a penalty or hurdle.

Producing content there was more economical and they quickly found … content can travel.

Global Stories – Pick your favorite genre and you can find hundreds of visual stories you can enjoy, experience created/produced by great professionals around the globe. The stories are different, the people are different, the surroundings are different but they’re all the same … interesting/exciting.

Thanks to the assistance of a strong set of industry standards and new technologies, it’s cheaper and easier to shoot, edit, and produce a film/show.

The global reach of the internet made it easier to share ideas, knowledge, advice and even tap into the best production/distribution expertise on the planet, day or night.

| The old business model was being dismantled right before Hollywood’s eyes. Studios accelerated their production output of what they did best … original titles. Originality – We often find it interesting and a little ironic when we stumble on a film/show we haven’t seen that captures our senses because right then, right there, it’s original,regardless of when it was released. With Wall Street’s urging/blessing, they put the stuff where it would do the most good … into their streaming libraries. The Street said the new content would translate into a growing subscriber base and ultimately – somewhere down the road – this would produce solid profits. The trouble is that didn’t happen. Studios were building their road to the future using the material from their old road – theaters and pay TV. They were focused on getting their share of the expanding entertainment business at any cost, paying little to no attention to the fact that they were undermining their old/proven model. Seasoned investor Warren Buffet bluntly said the approach was a particularly difficult environment in which to make money or more bluntly … the low-price model doesn’t work. It became even tougher and more obvious when the studios’ pipelines dried up during the dual WGA/SAG-AFTA shutdown. With the agreements signed, studio bosses said they will have to make adjustments in their productions going forward. Smaller budgets, tighter budget control. In other words, a reduction in production volume, trimming the use of A-list talent, smaller creative/production teams, less location filming. increased use of virtual production (VP) facilities and reduced spending on special effects and postproduction. New Interests – Thanks to global streaming, English speaking areas were suddenly exposed to interesting stories from around the globe and their interest, viewing soared. The lack of new US/Canadian content didn’t impact the new kids in the content production/distribution industry – Netflix, Prime and Apple TV+ – much. With the US market reaching its peak – 83 percent of consumers use D2C services this year according to Statista – they were already heavily focused on global growth and had strong relationships established in major global markets. Even before the ink was dry on the union agreements, studios were busy trying to figure out which projects could be saved, which had to be moved and which would become tax credits. Then came the really important calls … which production studios were available–especially studios located outside of Southern California. Don’t get us wrong, we love NoCal, like SoCal. But when it comes to content production locations; the cost of fees, permits, “extras” in the Hollywood area have made a lot of people say ABLA (anywhere but LA). And, they don’t have to look far. Creative Centers – Tax incentives and financial/staffing support have made it possible for new film/show production facilities to crop up everywhere and studios/streamers have been able to do superior creative work and improve their budget control. Advanced studios, complete with LED virtual production space have cropped up across the US, north/south of the border and around the globe. In addition, the cities and areas provide siginificant financial incentives to make local production even more enticing. The VP (virtual production) facilities allow studios to reduce/eliminate the cost of building sets, and location travel while lowering their carbon footprint. The production centers have also invested in all of the support structure a film, show or series would probably need. Beyond the Americas, major international film/series creative production hubs stand in stark contrast to the 50–100-year-old Hollywood facilities. Major production centers have been built in England and every country in the EU as well as Africa, Australia, New Zealand and other locals. Their goal is to capture a greater share of this year’s global $283B film/show/series market which is expected to grow to $345B by 2027. |

Expansion – US/Canadian streaming subscriptions have almost reached their peak with households having at least one streaming service. However, with a combined total of about 380K, TV households in the two countries and 1.8B TV households worldwide there’s still plenty of opportunities internationally.

While the streaming market continues to grow and mature, Ampere Analysis notes that Western European subscriptions will surpass the Americas next year. As a result, the Americas will fall to the third largest geographic region of total subscribers behind Asia and Western Europe.

Ampere projects that revenue from the Americas will reach saturation (110M subscribers) and will fall below 50 percent of the global revenue while Asia will account for 390.2M subscriptions and Western Europe 110.6M subscriptions producing higher annual revenues.

In other words, streamers will naturally turn to increasing international production to not only reduce costs but to bolster regional growth.

At the same time, they will also meet the non-English demands of North American viewers.

Win … win … win.

Born Global – The earliest pioneers of the streaming content industry knew Americans were tired of expensive cable Pay TV but they also saw a global market and reached out around the globe. As a result, they were well positioned with content when US creatives went on strike.

Oh. and if you’re interested, Netflix subscribers in Europe, Middle East and Africa exceeded North American numbers in 2022.

Netflix and Amazon have intentionally developed global libraries over the years to position themselves as one-stop-shop suppliers for all audiences.

Their share of non-US projects outstrips the share of demand for the content from all major streamers.

This stockpile of non-English content and established international relationships has become more valuable to them as other studios and streamers rush to develop/deliver new, unique content.

The global demand for streaming original content rose by 21.6 percent in the first half of this year.

Theoretically, the money spent on international production can go further and produce a better return.

The key isn’t to just produce less expensive stuff but to understand which genre appeals to the streamers’ audience and invest in the right projects.

Personal Insights – While pay TV services based content decisions on broad past market acceptance, streamers have been able to follow detailed, personal choice swings and see trends before they become glaringly apparent. This enables them to retain subscribers while attracting new viewers who will be interested in new, different content.

Understanding the shifting tastes in their key markets is something the technology-born streamers have done from the beginning. Then they expand that understanding as to the content that will resonate beyond their original regional market to higher ARPU (average regional per user) regions enables them to grow profitably.

According to Ampere, more than a quarter of the industry’s total original content expenditure by Netflix, Amazon, Apple, Disney, Paramount and WBD will be spent outside the US.

But the content investments aren’t equal.

WBD and Paramount have relied heavily on their first true loves – unscripted (cheap) content such as documentaries, true crime docuseries and dating/reality/game shows while Netflix, Amazon, Apple and Disney have leaned more heavily into scripted content.

Different goals for each of the firms produce different actions, which is why WBD shut down original production in several European regions and Disney took a hard pass on the digital cricket rights and even reassessed their ownership of Hotstar and Indian properties.

With strong rosters of scripted projects, Netflix and Amazon have cautiously been expanding their unscripted social experiment and reality output.

Travelability of genre matters today but language … not so much.

Common Language – Movies/shows “speak” in a common language to people and the dialogue/audio only enhances the story. Advanced localization services enable streamers to satisfy viewers hunger for new, different content regardless of the native language.

It’s true that English is used in most of the world’s films/shows; but in most of the countries, it’s a second language so, if you’re focused on capturing subscribers in France, Japan, Africa, India or other countries, you produce it first in the native language. Then make it travelable in other languages.

Doing it economically – and right the first time – has been a boon to localization providers such as 2G Digital Post that have taken the drudgery and expense out of the process for studios and streamers.

“With the increased need for languages to further engage audiences worldwide and the ease and intelligence of localization tools, the importance of dubbing and subtitling, and the opportunities it brings has overall benefited project creation and its distribution,”said Allan McLennan, president of 2G Digital Post.

“Localization has always been in demand by US creators and distributors who have needed to reach their full financial potential,” he noted. “Typically, a studio produced about 40 percent of their ticket sales in the US and 60 percent in other countries while international projects struggled to produce sound results in the Americas.

“Thanks in no small part to the global streaming services, exciting films and series produced in countries for their ‘home’ market are finding highly receptive audiences in the Americas and other regions around the world, many of which gain larger audiences when localized,” he added.

Based in the US in Burbank, CA, 2G Digital Post has additional facilities and development groups located strategically worldwide, in addition to their proprietary advanced intelligence technology. This enables the company to quickly, reliably and economically provision and localize each film/show so it appeals to all audiences … regardless of the language.

“The interesting thing content producers and we at 2G Digital Post have found is that they need to appeal to the total audience,” McLennan commented. “Most of the audience prefers the dialogue in their language while the other members of the audience prefer to see the film/show as it was originally produced in its native language with the dialogue in the subtitles.

“Our advanced automated intelligence tools and established high-quality control enable us to deliver a product that meets the high demands of translation accuracy that meet the audience segments’ entertainment needs,” he emphasized.

Services like 2G Digitals Post have opened up a whole new set of entertainment options for folks in the Americas and around the globe.

Interestingly, we sorta wish they would also convince all countries to consider using this kind of service when they bring their content to the US.

Sorta Common – English may be the most widely spoken language on the planet but there are many different flavors that can be interesting and “different.” CBS has found success in bringing BBC’s Ghosts UK and Australia’s NCIS: Sydney to the US market.

We’re avid viewers of BBC content, especially the flavor of their comedy. Always enjoyed visiting and chatting with our friends Down Under and even like chatting with our north of the border folks … Eh.

Sure, we liked it when CBS rolled out Ghosts UK and their line extension, NCIS: Sydney, to their line-up; but it’s like Goerge Bernard Shaw said, “we’re separated by a common language.”

Shaw only mentioned Britian, and we think the Aussies should be included.

We’ve come to realize what Jim Bennett in The Gambler said, “I know what I have to do.”

Yep, we simply have to listen more closely and … adapt.

Much as it hurts us to admit it, the content world doesn’t exist just for us…any of us.

Andy Marken – andy@markencom.com – is an author of more than 800 articles on management, marketing, communications, industry trends in media & entertainment, consumer electronics, software, and applications. An internationally recognized marketing/communications consultant with a broad range of technical and industry expertise especially in storage, storage management and film/video production fields; he has an extended range of relationships with business, industry trade press, online media, and industry analysts/consultants.

Find the top online casinos of 2025, offering secure transactions, generous bonuses, and a wide…

Start your crypto journey with the best exchanges and trading apps for beginners. Find platforms…

AUSTIN, TX / ACCESS Newswire / July 5, 2025 / Introduction: Our sense of hearing…

MIAMI, FL / ACCESS Newswire / July 5, 2025 / As summer approaches, weather services…

Check out the key features of the top crypto & Bitcoin casinos for July 2025: fast…

CORAL SPRINGS, FL / ACCESS Newswire / July 4, 2025 / CELFULL, a biotechnology company…