SiLC Technologies Raises $17M Series A Funding Round to Advance Machine Vision Applications

Developer of Industry’s First Integrated FMCW Imaging Chip on Track to Revolutionize 3D Sensing Market

MONROVIA, Calif.–(BUSINESS WIRE)–#ai–Machine vision innovator SiLC Technologies, Inc. today announced a $17 million Series A funding round led by Alter Venture Partners and Dell Technologies Capital with additional participation from Fluxunit – OSRAM Ventures, Sony Innovation Fund by IGV*, Epson, UMC Capital, Yamato Holdings and Global Brain. Following a $12 million seed round in 2020, the new financing brings SiLC’s total funding to over $30 million. The additional financing will be used to expand SiLC’s operations, accelerate product development and gain additional production design wins – all in preparation for pre-production and product launch activities.

Over the last year, SiLC has provided development systems to customers that are at the forefront of their respective market segments, including mobility, industrial machine vision, robotics, augmented reality, and consumer applications. The new funds will help further customer traction and support bringing these products to market.

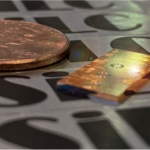

Currently being readied for broad deployment, SiLC’s advanced, production-ready 4D+ Vision Chip offers best-in-class performance metrics across range, resolution and accuracy for LiDARs. The 4D+ Vision Chip accomplishes this in a much smaller footprint and on an already proven scalable manufacturing platform. Additionally, it is the only solution on the market adding critical vector measurements including velocity, light polarization, and reflectivity. The additional information derived from this data provides context and greatly improves perception of the environment, a breakthrough that has wide-ranging applications for autonomous vehicles, biometrics and security, robotics, and more.

“Image processing capabilities of AI systems remain vastly inferior to those of humans, despite the use of massive computing power and high-resolution camera sensors,” said Mehdi Asghari, founder and CEO, SiLC. “The key difference is that our visual cognition is based on far more information than traditional image sensors. Our 4D+ vision sensors provide critical additional data and cues needed for efficient machine image processing and visual cognition much like the human eye does to the brain. The quality of investors we have attracted underscores the transformative potential of SiLC’s unique technology. This latest funding round will be critical as we continue on our journey towards revolutionizing the 3D sensor market.”

Investors Speak Out on SiLC

- “SiLC has differentiated itself by being the only company to date that has successfully integrated an FMCW imaging system on a cost-effective silicon platform, giving them huge potential in the large, fast-growing imaging market,” said Daniel Docter, managing director, Dell Technologies Capital. “SiLC’s approach is the only viable one for the large-scale adoption needed to advance the state of robotics, autonomous vehicles, biometrics, security, and more.”

- “We are focused on advancing our position at the forefront of LiDAR technology, and thus understand the impact of SILC’s approach will have to enable human-like perception across autonomous driving, robotics, smart cameras and beyond,” noted Sebastian Stamm, principal at Fluxunit – OSRAM Ventures. “We are impressed by the team’s accomplishments in silicon photonics and the unprecedented level of integration and scalability of their FMCW chip, which will be key for broad adoption of coherent 3D sensing.”

- “We believe that companies with strong core technologies can be market disruptors,” noted Louis Toth, managing partner, Alter Venture Partners. “The prior entrepreneurial successes of the SiLC executive team coupled with deep engineering expertise in optics, semiconductor design, networking, and embedded application software development will enable the company to overcome hard technical limitations that have previously plagued imaging, opening doors to a new era of smart automation.”

- “Building on its silicon photonics expertise, the SiLC team takes an innovative, fully solid-state approach to LiDAR. Its FMCW solution makes autonomy safer in various environments thanks to its long-range and high-resolution sensing,” said Gen Tsuchikawa, chief investment manager for Sony Innovation Fund (SIF) and CEO and chief investment officer for Innovation Growth Ventures (IGV). “Our investment in SiLC further expands our Mobility portfolio, and we look forward to SiLC growing its business across the automotive, robotics and industrial markets.”

- “SiLC’s technology is a game changer, their solution enables legacy based LiDAR’s transition towards FMCW, their highly integrated solution enables scalability and shrink-ability and at scale,” said Kris Peng, president at UMC Capital. “SiLC has the potential to usher in a new era of white box AI which can measure full motion of all objects without any training data nor HD map taking away the guess work required for existing solutions.”

Founded in 2018 by a team with more than 25 years of experience in photonics, SiLC has developed a significant body of intellectual property, as well as a proprietary process for manufacturing high-performance optical components at large scale. The result is the creation of the industry’s first and only fully integrated FMCW 4D imaging chip – a significant step forward in the quest to make machine vision more like human vision.

For more information, please visit www.silc.com.

About Alter Venture Partners

Alter Venture Partners is an early-stage venture capital fund that partners with dynamic entrepreneurs who are passionate about solving challenging problems with innovative technology. Alter was founded by experienced operating executives and investment professionals from Telefonica, Comcast Ventures, Singtel Innov8, and Credit Suisse. In addition to capital, Alter provides strategic insights, industry knowledge, operating experience, and an extensive global network of contacts to its portfolio companies. The fund’s focus areas include networking, mobility, cloud, data, ML/AI, and cyber security. Alter has offices in San Francisco and Lisbon. Additional information on the fund can be found at www.altervp.com.

About Dell Technologies Capital

The Dell Technologies Capital investment team is comprised of company builders with the mission of helping founders and their teams develop innovative technology solutions and bring them to market. They are active investors, sustaining an investment pace of approximately $150 million a year. As the global investment practice for the Dell Technologies family of businesses (Dell, Dell EMC, Pivotal, RSA, SecureWorks, Virtustream and VMware), Dell Technologies Capital offers deep business and technical expertise and unparalleled go-to-market assistance to our portfolio companies. After operating in stealth for five years, the venture practice emerged publicly in 2017. Headquartered in Palo Alto, Calif., Dell Technologies Capital currently has offices in Boston, Austin and Herzliya, Israel. For more information visit www.delltechnologies.com/capital.

About SiLC Technologies

On a mission to enable machines to see like humans, SiLC Technologies is bringing forth its deep expertise in silicon photonics to advance market deployment of coherent 4D imaging solutions. The company’s breakthrough chip integrates all photonics functions needed to enable a coherent 4D vision sensor offering a tiny footprint while addressing the need for low cost and low power. Demonstrations have shown a range beyond 300 meters and are applicable to a wide range of applications.

Founded in 2018 by silicon photonics industry veterans with decades of commercial product development and manufacturing experience, SiLC uses a proprietary silicon-based semiconductor fabrication process to manufacture its chips and standard, automated IC style assembly processes, enabling robust, cost-effective and compact solutions.

For more information, visit www.silc.com or connect with the company on LinkedIn.

*Innovation Growth Ventures Co., Ltd. (IGV) is managed by Sony Innovation Fund and Daiwa Capital Holdings.

Contacts

Rachel Mayhew

Lages & Associates

(949) 453-8080

rachel@lages.com