Strategy Analytics: Google’s Share of Global Digital Media Revenues Declined By 2.7% in Q2 To A Six-Year Low

Google hit by pandemic-related cuts in ad spend, but Alibaba and Facebook continued to grow

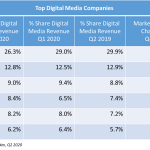

BOSTON–(BUSINESS WIRE)–While it is still the world’s largest digital media company by some distance, Google’s digital media revenues fell by 7.0% in Q2 2020 to $38.3B, causing its market share to fall from 29.0% in Q1 2020 to 26.3% in Q2, its lowest share of the global digital media market in the past six years. According to the TV and Media Strategies report, Digital Media Global Competition Review Q2 2020, the major factor was the decline in travel and leisure advertising, in which Google is particularly strong, as a result of behavioral changes brought about by the COVID-19 pandemic. Facebook remained the world’s number two player, with a 12.8% share in Q2, while Apple remained in third place, in spite of a decline in market share to 9.0%. Alibaba, the world’s fourth largest digital media company, was helped by a resurgent Chinese economy and saw its share rise to 8.4% in Q2.

The report also found that overall global digital media revenues saw modest quarterly growth of 2.8% in Q2 2020, as the global economy slowly began to recover from the initial impact of the COVID-19 pandemic, and Q2 revenues of $145.7B were also nearly 12% higher than a year earlier. The strongest digital media sector was online games, where Q2 revenues increased by 12.9% over Q1. Digital music revenues fell by 11.4% as time spent listening to streaming music declined in Q2. Online video revenues rose by 2.8% and digital advertising revenues were more or less flat.

“The digital media industry has been affected by the pandemic in different ways, depending on segment and geography,” says Michael Goodman, Director, TV & Media Strategies and the report’s author. “China’s recovery in Q2 is an indication that western firms like Google should hope for a similar bounce during the rest of 2020, but there is clearly still a great deal of uncertainty. Firms focusing on entertainment sectors such as video and games have tended to demonstrate superior revenue growth more recently and there is good reason to expect this trend to continue through the rest of the year.”

Methodology

This analysis is based on Strategy Analytics’ Digital Media Index (DMI), which has been analyzing quarterly digital media revenue trends for 44 of the world’s largest publicly traded companies across games, video, music, social media and digital advertising for the past 15 years. Revenue figures are compiled from quarterly financial filings and other public statements as well as our own estimates of market and company sector revenues. Analysis includes only digital (internet) revenues and excludes traditional media segments.

Source: Strategy Analytics, Inc.

#SA_Media&Services

About Strategy Analytics

Strategy Analytics, Inc. is a global leader in supporting companies across their planning lifecycle through a range of customized market research solutions. Our multi-discipline capabilities include: industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in: smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need. For more information, visit us at www.strategyanalytics.com.

For more information about Strategy Analytics

Television & Media Strategies

Contacts

U.S. Contact: Michael Goodman, +1 617 614 0769, mgoodman@strategyanalytics.com

European Contact: David Mercer, +44 1908 423 610, dmercer@strategyanalytics.com